Why Insurance Companies Choose Orangescrum

Designed for the fast-paced insurance industry, Orangescrum keeps your operations, compliance, and customer service on track.

Faster Policy & Claims Processing

Regulatory Compliance Made Simple

Improved Team Collaboration

Data-Driven Decisions

Templates

Orangescrum's project management template for insurance projects is designed to streamline operations, enhance collaboration, and improve efficiency within insurance companies.

Policy Administration

Efficiently manage policy creation, renewal, and updates, ensuring all client information is accurate and up-to-date.

Claims Processing

Link policy details with claims information to streamline the processing and approval of insurance claims.

Customer Service

Track and manage customer service interactions to ensure prompt and effective resolution of client inquiries and issues.

Questions? We’re Here to Help

Ask us anything about Orangescrum: features, pricing, integrations, or self-hosted setup.

Contact Customer Support

see why teams love working with us.

Features Built for Insurance Professionals

Everything you need to manage policies, claims, compliance, and teams in one platform.

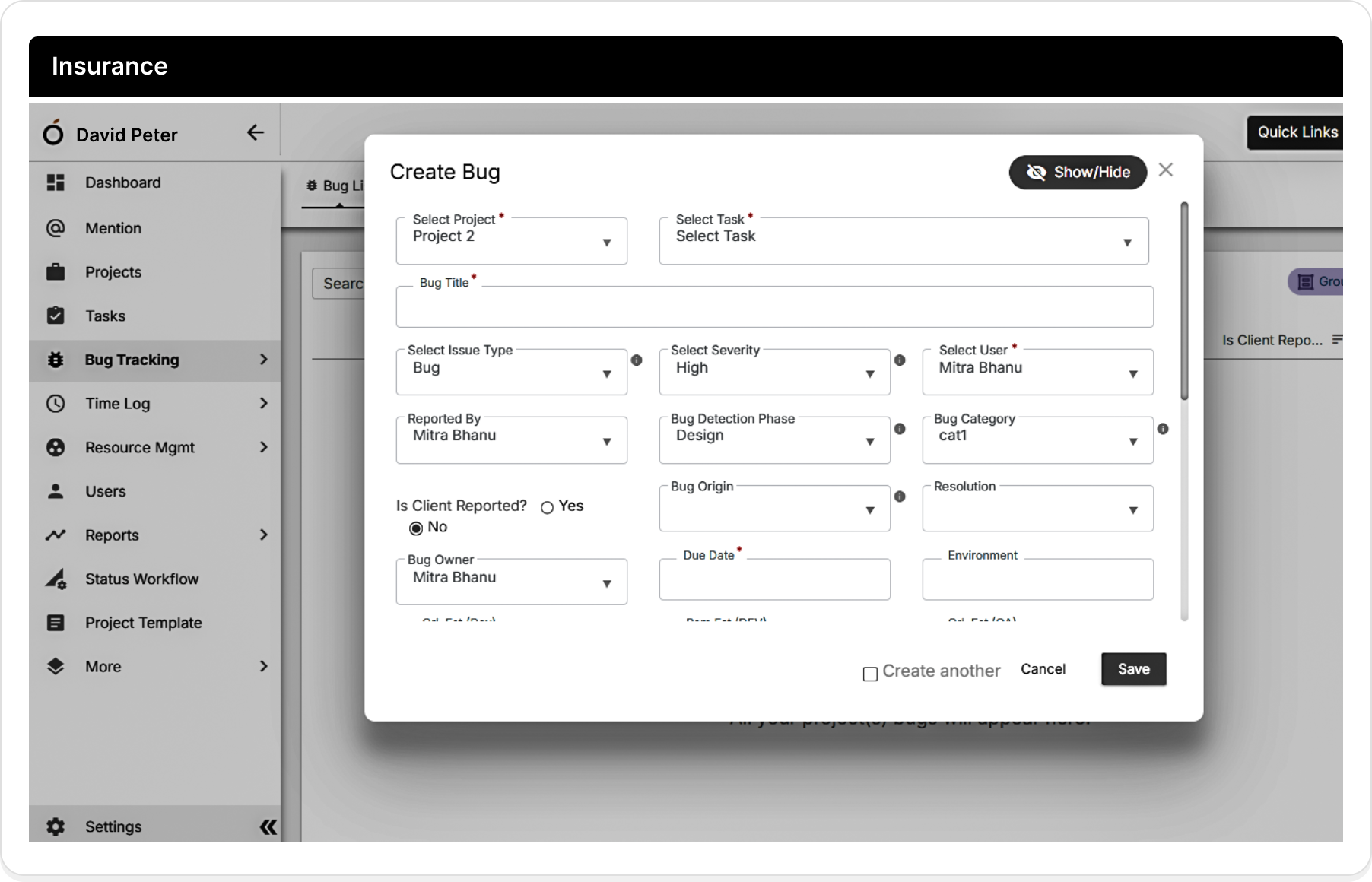

Claims Management

Policy Tracking

Compliance Monitoring

Customer Communication Logs

Task Automation

Performance Dashboards

Orangescrum helped broad customers to build their successful workflow!

"Since switching to Orangescrum, our remote teams collaborate better than ever. The real-time updates are a game-changer. We’ve seen a 30% drop in miscommunication."

Emily Rodriguez

Marketing Head

"My team (Hailstorm-Development) and I LOVE Orangescrum! We are a flextime remote business solution specialist agency, and this tool has enabled us to actually create this company. Without you all, we wouldn't even exist!"

Hayley Turner

Founder & CEO, United States, Michigan

"Orangescrum simplifies the process of project management for our organization with its power collaboration tools and provides seamless support and on-boarding. We couldn't be happier with Orangescrum!"

Jamie Smith

Director of Marketing Automation, SFCG, Texas

"We finally have a single place to track tasks, deadlines, and team progress. Orangescrum makes project tracking effortless. Our weekly standups are now more focused and data-driven."

Sneha Nair

Operations Lead

"I work with Freelancers to get the CAD jobs done. Orangescrum provided my team with a way to track and bill their time directly on the project they are working on. This saved me a lot of administrative work."

Brent Kerr

CEO, Kewico GmbH

"We love the customizable workflows in Orangescrum. It adapts perfectly to our internal processes. It feels like the tool was built for us"

Aliya Nurzhanova

Team Lead

"I was very impressed with the ease of use of its interface and all its features to manage projects. It is a platform that can be customized to our needs. Migrating my projects to Orangescrum was super easy."

Clotilde Jolimaitre Rodriguez

Digital Project Manage, Imagevo France

"The most beautiful thing about Orangescrum is its ease in its approach which makes it a lot simpler to use. Orangescrum makes a complicated project way easier to run within my team."

Kuda Msipa

CEO Cutmec Group, Bristol, United Kingdom

"Our major chellenge was to manage multiple Projects/multiple clients at the same time. So we needed something more than excel sheets to manage the development velocity and make things automated."

Shan Sashidharan

Director Of Technology At Techuva Solutions

"Orangescrum helped us streamline project workflows across departments. Task clarity and accountability have improved significantly. It’s now easier to meet deadlines without chaos."

David Miller

Project Manager

Blogs

Stay ahead with the Latest Insights

Orangescrum Enterprise Release: End-to-End Epic Management

Everything You Need to Know About Resource-Constrained Scheduling

Master the Critical Path Method (CPM) for Smarter Project Scheduling